Who buys super-premium pay-TV?

Why launch a new Super-premium product?

The brief

Viasat Broadcasting operates free-TV and pay-TV in Scandinavia and Eastern Europe, with emerging market operations in the Baltics, Russia and the Ukraine. In total Viasat operates pay-TV platforms in 35 markets.

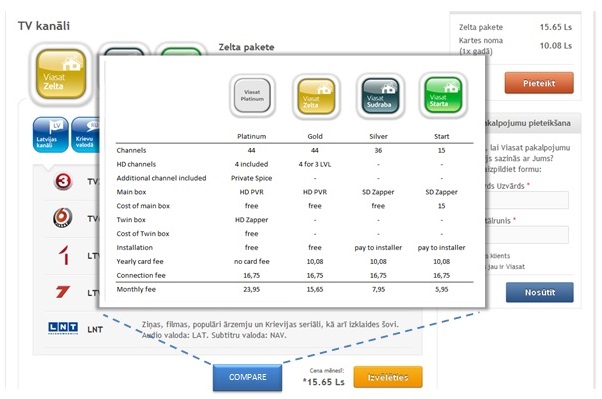

The emerging Eastern European markets are fast paced and dynamic, with multiple languages, with social, regulatory and political challenges, and with distinctive local cultures. Best practice in subscription pay-TV is to package your products into ‘Good-Better-Best’ bundles. Viasat promoted these three packages of product into the Baltic markets successfully with over 250,000 pay-TV subscribers. But growth had slowed, and Viasat needed a stepchange in performance. Plus sales of pay-TV by level of package were too ‘bottom heavy’ with disappointing Average Revenue per User/per Unit (ARPU).

Strategy

Our review focussed on the need to grow revenue per user. Our analysis suggested that there was a small market for a super-premium product to sit above the existing ‘Best’ product, appealing to more affluent segments of the Baltic markets. Plus we knew that promoting a Super-Premium product in the right way and at the right price could also change the dynamic to benefit the ‘middle’ Better and Best products sitting below it. So the strategy we proposed was to design, build and launch a new Super-premium product at a high pricepoint – to sell at high margin, but more importantly to benefit the mid-range products positioned below it.

Actions

Within six weeks we’d designed and specified a new, ‘fully loaded’ Super-premium product which offered all of the best features and benefits available. Within eight weeks we’d researched it to quantify the range of likely demand. Within ten weeks we began to register interest from customers and by week 12 we started to offer the product in our first market, Latvia.

In pricing psychology, this makes use of Good-Better-Best together with Goldilocks pricing. Plus it applies both high pricepoint and low pricepoint anchors, with the high pricepoint in particular acting as a decoy; and it draws on Extremeness aversion to favour the ‘middle products’.

The big difference

After the first six months we found that 7% of customers would take up an offer of the new Superpremium product. But the biggest difference we made was to change the overall dynamic in favour of the ‘next product down’ which grew from 22% to 28% of all sales. As a result of the performance improvement for both top products we grew Average Revenue per Unit / per User in Latvia by over +20% year on year with 34% of customers taking one or other premium product.

Click here to read more case studies in international marketing management.

Or click here to get in contact