Good, better, best. Superpremium. And the $28,000 handbag

What $28,000 Fendi handbags are really there to do …

The brief

A new mantra for planning products as a portfolio has become ‘good, better, best’. Planning levels of product or service to appeal to as broad a market as possible, at different pricepoints and margins. Planning products as a portfolio, with pricepoints set relative to each other can have surprisingly healthy results.

Although this usually applies to products within a portfolio, in a text book case study, Budweiser came under heavy competitive pressure, losing share to lower-priced Miller. Budweiser needed to rethink to change the situation. Applying a product portfolio perspective to their market category led them to an answer.

Strategy

Recent thinking has moved on from ‘good, better, best’. Research and case studies have told us that whatever market you have, between 5% and 15% of your market will be interested in your best available product or service. So add a super-premium option at high margin and you’re giving that segment somewhere to go. Even if your Superpremium product doesn’t sell, the halo effect, otherwise known as ‘the Goldilocks effect’ can benefit the next product down.

So if a high pricepoint anchor works in luxury goods, such as one of the world’s most expensive ‘on sale on the high street’ handbags, the $28,000 Fendi B.Bag, then why not for you too? Or why not for Budweiser?

Actions

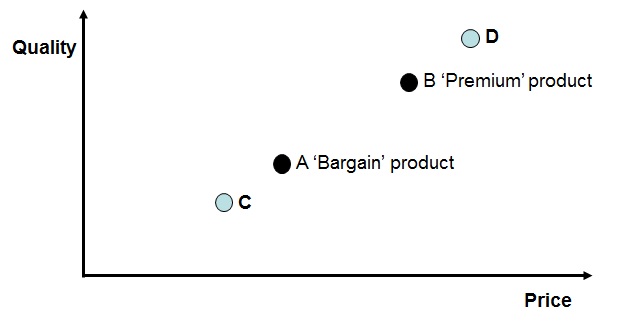

Budweiser developed a theory that by promoting a super-premium beer brand, Michelob (D), it might disrupt the market, shifting customers up and away from Miller (A). Benefitting Michelob (D), but also benefitting Budweiser (B).

customers up and away from Miller (A). Benefitting Michelob (D), but also benefitting Budweiser (B).

Psychologists have run carefully measured experiments to test and prove the market impact Budweiser set out to engineer. The experiments proved the reaction that Budweiser wanted. They also showed that the best response from Miller would be to launch a bargain basement product (C) to apply the same logic and principles, but applying them in the other direction to drag customers down to Miller.

The big difference

The high profile promotion of Michelob worked, disrupting the market and reversing the loss of share to Miller. Budweiser changed the market, through using Michelob as a high pricepoint anchor, and as a decoy to draw share away from Miller.

In studies the effects are also very clear. In pricing consulting applying pricing psychology, it leverages several proven principles including the use and effect of high or low pricepoint anchors, decoy pricing and products and to a lesser degree extremeness aversion which favours ‘middle choices’.

To find out more about planning pricepoints & portfolio pricing – Click here to get in contact